Want to own a piece of movie history? You may get your chance when Profiles In History, the world’s largest auctioneer of Hollywood memorabilia, bangs the gavel on the highly anticipated Hollywood Auction beginning September 29.

The auction, which will run through October 1, 2015, features a number of items straight off of the silver screen including:

•Ron Howard (Steve) original screen-used custom 1958 Chevrolet Impala from American Graffiti ($800,000 – $1,200,000);

•Carrie Fisher “Slave Leia” costume collection and display from Star Wars: Episode VI – Return of the Jedi ($80,000 – $120,000);

•Harrison Ford signature screen used bullwhip with accompanying Harrison Ford LOA from the Indiana Jones movies ($100,000 – $150,000);

•Julie Andrews (Maria) screen used acoustic guitar from The Sound of Music ($15,000 – $20,000);

•Michael J. Fox (Marty McFly) 2015 Nike NKE -0.41% Mags self-lacing shoes from Back To The Future II ($30,000 – $50,000);

•Clark Gable (Rhett Butler) vintage original screen worn riding jacket from Gone With The Wind ($40,000 – $60,000);

•Original screen-used hero Alien Creature head by H.R. Giger from Alien ($60,000 – $80,000); and

•Robert Shaw “Quint” hero harpoon rifle from Jaws ($60,000 – $80,000).

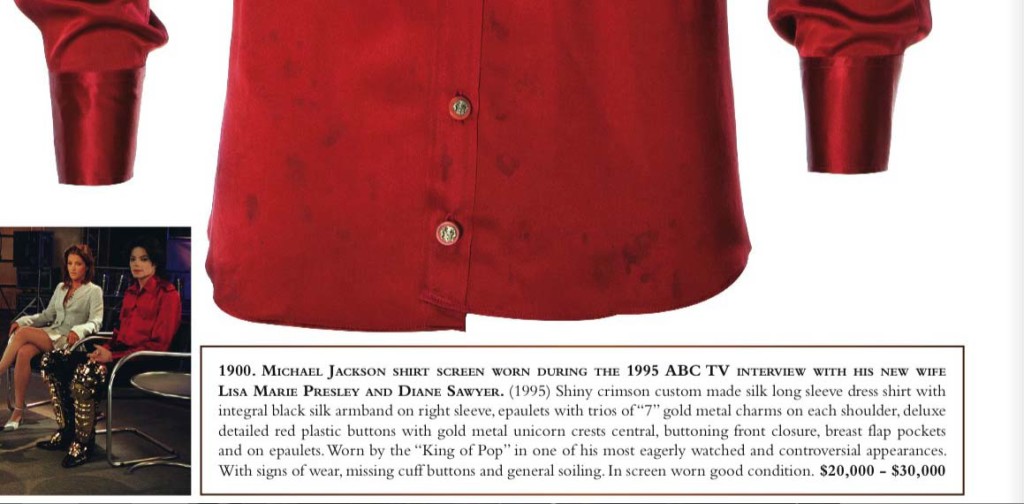

A variety of items from TV and music are also available, including the “General Lee” from The Dukes of Hazzard, the Michael Jackson shirt screen worn during the 1995 ABC TV interview with his new wife, Lisa Marie Presley, and Taylor Swift’s Billboard Music Awards performance bracelet.

Joe Maddalena, President/CEO, Profiles in History said, about the auction:

“

Without question, this sale represents the largest and finest offering of film, television and music artifacts we have ever assembled. Literally every film and television genre is covered with monumentally important pieces from titles such as Citizen Kane, Sunset Blvd., Gone With the Wind, The Sound of Music, American Graffiti, Star Wars and Jaws, just to name a few. There is something here for everybody.

What happens if you’re lucky enough to come up with the winning bid for one of the items? Besides owning a cool piece of entertainment history, you would own a valuable asset – and of course, that brings tax consequences.

For tax purposes, almost everything you own and use for personal or business purposes is a capital asset. “Everything” is awfully broad and yes, it really does mean everything. While we tend to think of capital assets in terms of stock shares and real estate, capital assets also include personal property and collectibles. I like to think of personal property as non-business items that you can touch (think furniture, jewelry and the like). Collectibles include stamp and coin collections, as well as other kinds of items that you might find in collections like wine and art; it also includes one of a kind items like the ones offered for sale at auction.

When you buy a capital asset for personal use, there’s generally no immediate tax consequence to you. The price that you pay, plus any broker or auction house fees and the cost of maintaining or preserving the item, is your basis.

If the value of the item fluctuates during the time that you hold it, there’s no tax consequence to you. However, when you sell or otherwise dispose of a capital asset, there may be a tax consequence to you. The difference between the sales price (less plus any broker or auction house fees) and your basis in the asset is a capital gain if you made money on the sale or a capital loss if you lost money on the sale.

(See this article on basis and realized gains and losses.)

How much tax you’ll pay on a gain is determined by two things: how long you owned the asset and your personal income tax bracket. If you hold a capital asset for more than a year, you have a long term capital gain. Taxpayers who are in the 10% and 15% tax brackets for ordinary income pay a long term capital gains rate of 0%. Taxpayers who are in the 25%, 28%, 33%, or 35% tax brackets for ordinary income pay a long term capital gains rate of 15%. Taxpayers who are in the top tax bracket at 39.6% pay a long term capital gains rate of 20%.

If you hold a capital asset for less than a year, your tax rate is the same as your ordinary income tax bracket.

(Note those are the 2015 rates. You can review the 2015 tax rates here and check out the 2016 tax rate projections here.)

Of course, this is tax law and nothing is ever simple when it comes to tax law. There are a lot of exceptions and one of those exceptions apply to collectibles. Collectibles, which may include collections, antiques and unique items (even if they have little value) are not taxed at the “normal” long term capital gains rate but rather at a relatively high maximum 28% rate.

There’s another exception to the rule. While you pay capital gains tax on all capital assets when you make money (meaning you sold the asset for more than your basis), you don’t get a break on all capital losses (meaning you sold an asset for less than your basis). Specifically, you’re not allowed to deduct capital losses on the sale of personal use property. Personal use property includes items like your house and your car – and it may include collectibles.

Why “may include” and not “will include” collectibles? The characterization of the property is facts and circumstances dependent. Picking up one or two Hollywood collectibles that you display in your home likely qualifies as personal use: it’s for your own enjoyment. But if, say, you are collecting Oscar statuettes with the intent to sell them later, you might be able to make the argument that the property is an investment, not personal use: investment property would be subject to those “normal” capital gains rates. Again, facts and circumstances control.

What if, instead of selling, you decide to donate your collectibles? If it’s a collectible of modest value, you’ll want to estimate the value for purposes of calculating your deduction. If it’s valuable, rare or special, you’ll want to get an appraisal to support the value of your deduction. That’s absolutely the case if your donations are worth $5,000 or more. Special rules apply for art and other valuables worth $20,000 or more. You should always get an appraisal if you’re hoping to donate property with significant value.

The rules for buying and selling collectibles can be tricky. If you’re looking to spend a little money to put a movie poster on your wall for personal use, you probably don’t need to worry too much about the tax consequences. But if you’re looking to spend a little more to hold as an investment or if the item has significant value, it’s best to consult with a tax professional.

Want more taxgirl goodness? Pick your poison: follow me on twitter, hang out on Facebook and Google, play on Pinterest or check out my YouTube channel. For cases and tax related docs, visit Scribd.